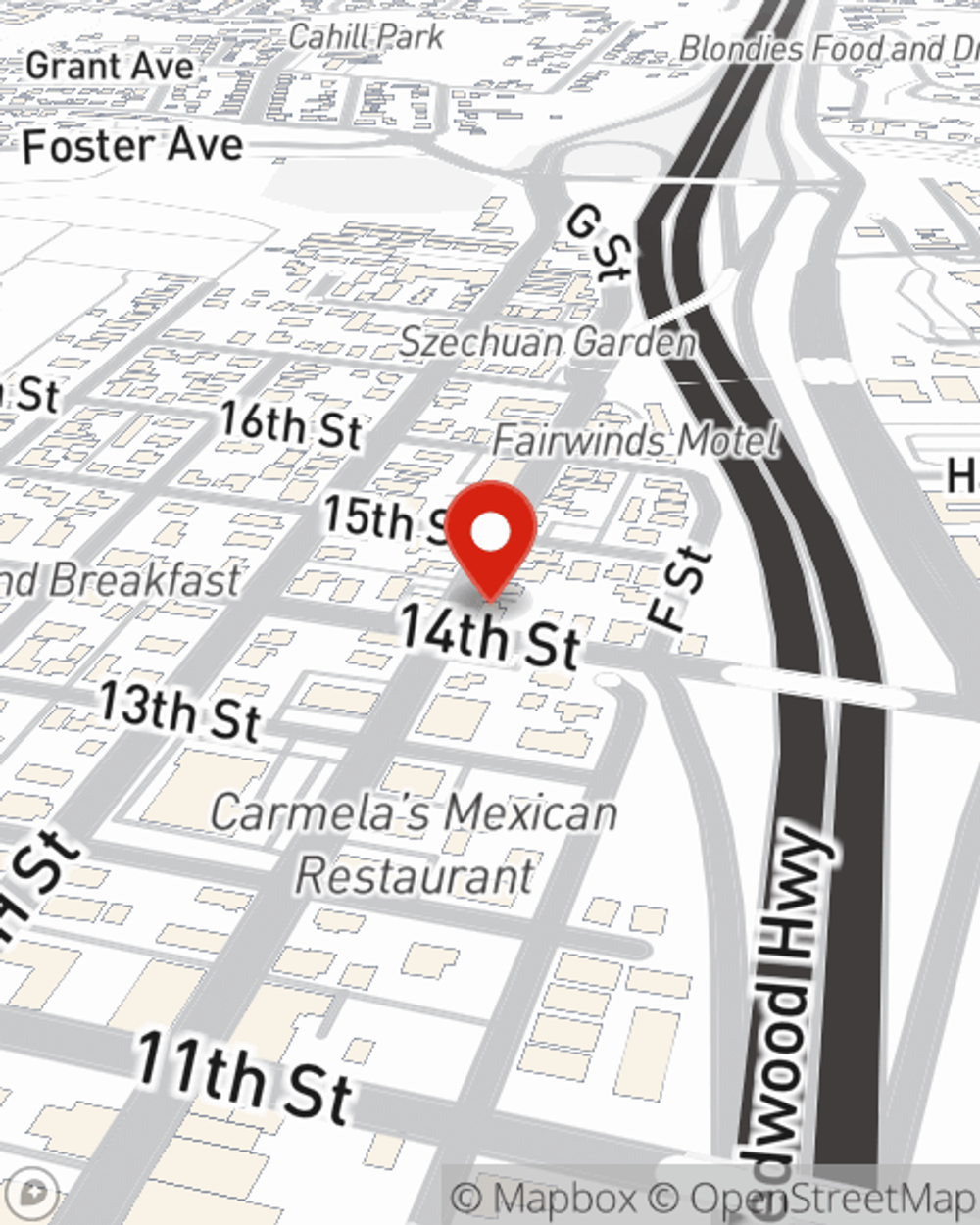

Business Insurance in and around Arcata

Get your Arcata business covered, right here!

Helping insure small businesses since 1935

- Arcata CA

- Eureka CA

- Mckinleyville CA

- Humboldt County, CA

- Fortuna CA

- Blue Lake CA

- Oregon

- Portland Or.

- Medford Or.

- California

- Redding CA

- Shasta CA

- Santa Rosa CA

- Arizona

- Manila CA

- Millville CA

- Shasta County, CA

- Willow Creek, CA

- Sacramento CA

- Los Angeles, CA

- Anaheim, CA

- Roseville CA

Help Protect Your Business With State Farm.

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, specialized professions, trades and more!

Get your Arcata business covered, right here!

Helping insure small businesses since 1935

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, commercial liability umbrella policies or worker’s compensation.

As a small business owner as well, agent Traci Day understands that there is a lot on your plate. Get in touch with Traci Day today to discover your options.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Traci Day

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.